Dollar rebound continues on US services recovery

- Latest

Hopes that US President Trump could be ready to roll back some of the tariffs he imposed on China as part of the ‘phase one’ trade deal helped boost the dollar against the safe-haven currencies on Tuesday, as did an increase in US Treasury yields.

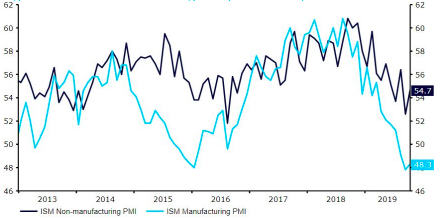

Figure 1: US Non-manufacturing PMI (2013 – 2019) 62

Other data points out of the US yesterday were a bit of a mixed bag, which included a slowdown in job openings. This was, however, not enough to deter the dollar bulls that sent EUR/USD around half a percent lower, back below the 1.11 level. This marks the lowest level in the critical pair since around mid-October.

A couple of speeches from Federal Reserve members Evans and Williams are on the docket for today.

Any signs that either or both members are erring towards supporting a prolonged period of stable

interest rates could provide additional support for the dollar today.

Euro Area services PMI rebounds from lows

Focus in the Euro Area this morning was squarely on the all-important services and composite PMls, neither or which disappointed. The former increased unexpectedly back to 52.2 in October, while the latter also rose to 50.6 from the previous 50.2. While the uptick is of course encouraging, this still remains at a pretty precarious level and only just in expansionary territory. Expectations for a disappointing retail sales print later this morning are, however, pretty rampant, with optimism that the bloc’s economy is heading towards a sustained recovery still undoubtedly low. Investors are pencilling in retail sales near flat month-on-month for September.

With news out of Brexit likely to be light on the ground until the December election, sterling has been trading within a fairly narrow range by recent standards in the past 24 hours or so. There was very little reaction among traders to yesterday’s UK services PMI, which rose back to the level of 50 that denotes zero growth. The market undoubtedly has one eye on tomorrow’s Bank of England meeting, although as we mentioned on Tuesday, this is likely to be a fairly neutral event for the currency markets.