Powell rebuffs calls for more US interest rate cuts

- Latest

The euro continued to hover around the psychological 1.10 level against the US dollar on Thursday morning, with markets largely taking Fed Chair Jerome Powell’s comments at Congress in its stride.

Powell’s comments very much reinforce our existing view – the Fed is likely to stand pat for at least the next four or five months or so, before it reassesses the impact its recent cuts have had on the US economy. The market was clearly already in agreement prior to Powell’s remarks, with the reaction in EUR/USD very minimal.

UK inflation slumps to three-year low

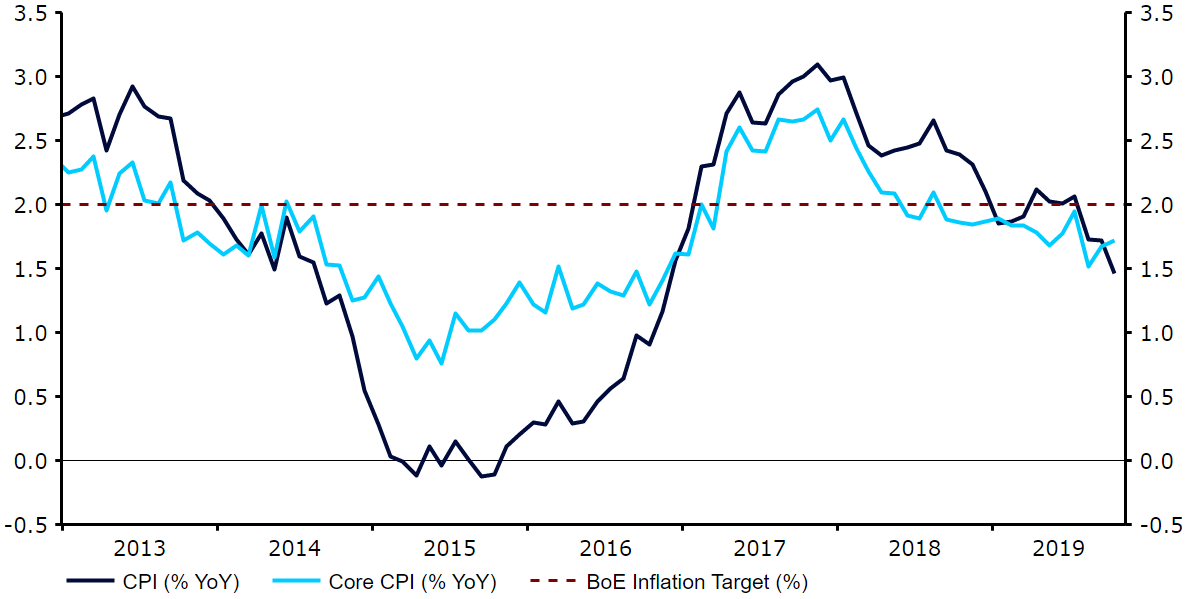

We’ve had a host of macroeconomic data releases in the UK in the past 24 hours or so, all of which has surprised to the downside. Headline inflation fell again in September, declining to a three-year low 1.5%, well below the Bank of England’s 2% target. Retail sales figures out this morning were also pretty soft, with sales falling by 0.1% month-on-month in October. All in all, the picture is not great, with the data heaping additional pressure on the Bank of England to follow in the footsteps of some of its major peers in easing policy.

Figure 1: UK Inflation Rate (2013 – 2019)

The reaction in the pound has, however, been almost non-existent, with the currency trading within a very narrow band against the US dollar since Monday afternoon. As we mentioned last week, investors are almost completely fixated with Brexit, so until we get more concrete news on that front macroeconomic news is likely to go somewhat under the radar.

Investors await Eurozone inflation data

Despite briefly edging back below the 1.10 level this morning, the euro has mostly held its own in the past couple of sessions.

A mild improvement in macroeconomic data out of the Euro Area can be partly attributed to the lack of a more sustained sell-off in the common currency. Industrial production numbers came in modestly better-than-expected yesterday, although output in the sector remained deep in negative territory at -1.7% year-on-year. With this morning’s third-quarter growth numbers left unrevised from the preliminary estimate, attention will now turn to tomorrow morning’s all-important inflation numbers.