Sterling holds its own despite growing BoE rate cut bets

- Latest

The pound continued to remain remarkably resilient against its major peers on Tuesday morning, rallying back above the 1.30 mark against the US dollar despite the market’s lofty expectations in favour of a January interest rate cut from the Bank of England.

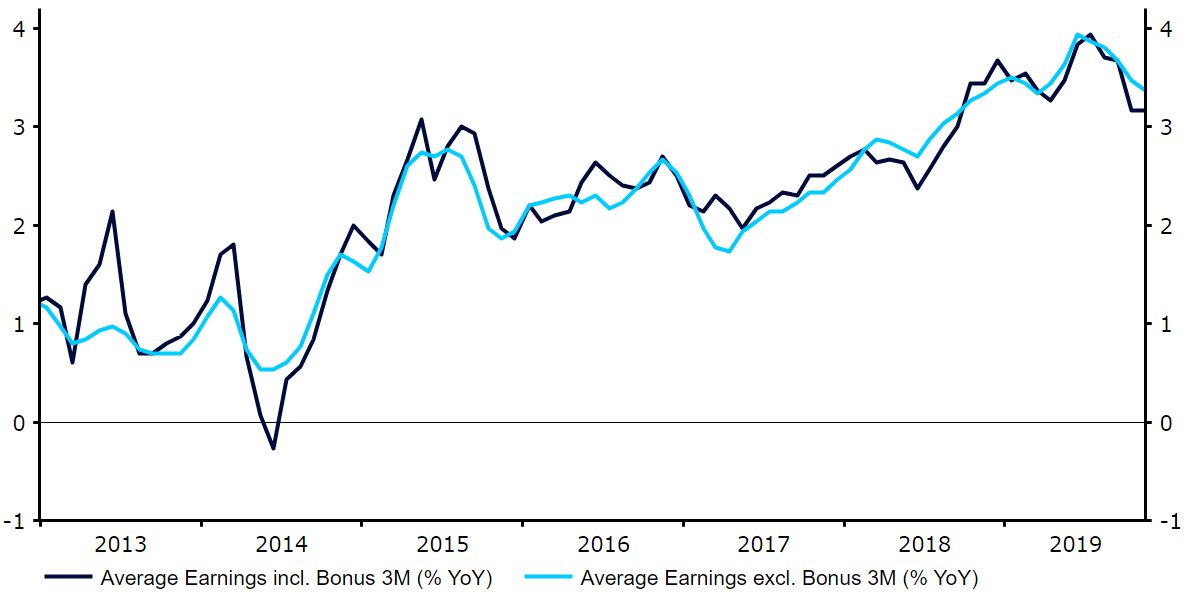

These expectations were, however, tempered slightly following this morning’s fairly encouraging UK labour data, which triggered around a 40 pip move higher in the GBP/USD cross. While the unemployment rate remained unchanged, earnings growth including bonuses surprised to the upside, coming in at 3.2% year-on-year – still comfortably above the level of inflation.

Figure 1: UK Average Earnings Growth (2013 – 2019)

We think that the key to whether or not the Bank of England cuts interest rates next week now may well lie with Friday’s business activity PMI data for January. Investors are bracing for a modest move higher in the crucial services index to around the 50.9 level from December’s 50.0. It is worth remembering that the January number will be the first full month of data received post-Boris Johnson’s emphatic election victory in December, which effectively removed the entirety of the short-term ‘no deal’ Brexit uncertainty. Should this be reflected in a significant way in Friday’s services index, i.e. a reading anywhere in the 52.0-53.0 vicinity, then we think this would provide enough justification for policymakers to hold off from cutting rates when it meets next week. By contrast, another disappointing reading that suggests the UK economy barely grew in January would probably cement the case for a rate cut later this month.

Euro Area sentiment jumps to near 2-year high

Activity in the EUR/USD cross is yet to really get going so far this week, with the pair spending much of trading on Monday hovering around the 1.11 mark.

There was not much to report out of the US yesterday, largely a result of the Martin Luthor King federal holiday. Currency traders will instead be looking to Switzerland and the Davos Economic Forum that commences today. President Trump will be delivering a keynote speech this morning, followed by various other appearances from political and central bank heads, including Angela Merkel and Christine Lagarde.

On the data front, the euro received a bit of support from this morning’s ZEW economic sentiment data, which provided further evidence to our view that activity in the bloc is due to pick-up pace going into 2020. The index for the Euro Area jumped to 25.6 this month, its highest level since the beginning of 2018. This is a very encouraging uptrend which we believe is likely to help buoy the common currency this year, provided it translates itself into a move higher in hard data.